Why Finance Apps Use Casino Elements to Engage Users

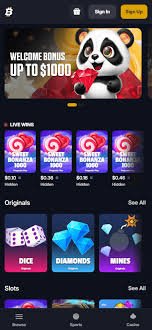

In recent years, the world of finance has seen a significant shift towards integrating gamification strategies to enhance user engagement. Finance apps are increasingly adopting elements traditionally associated with casinos to make financial management more appealing to the average user. By employing techniques reminiscent of Why Finance Apps Use Casino Psychology Bitfortune slot games, finance applications aim to transform tedious tasks into enjoyable experiences. This article will explore the reasons behind this trend, the benefits it offers, and the potential pitfalls that developers should consider.

The Gamification Trend

Gamification is defined as the application of game-design elements in non-game contexts to improve user engagement and motivation. In the landscape of finance apps, gamification serves several purposes: it incentivizes users to save money, invest smarter, and manage expenses effectively. By drawing on the same principles that make casino gaming so addictive—such as rewards, competition, and interactivity—finance apps can create a more engaging user experience.

Understanding User Behavior

Research indicates that emotional stimuli often drive user decisions. This is one reason why finance apps incorporate casino-like features. Users are more likely to engage with their financial health when incentives, rewards, and the thrill of competition are involved. For instance, achievements, badges, or leaderboards can motivate users to reach their financial goals, similar to how players strive to win in a casino environment.

The Psychology of Rewards

In a casino, players experience high-stakes rewards which create a sense of excitement and pleasure. Finance apps mimic this by implementing reward systems, such as bonuses for hitting savings targets or completing educational bonuses. The anticipation of reward not only captivates users but also encourages good financial habits, making the app an ally in achieving their financial goals.

Engagement Through Competition

Many finance apps now incorporate elements of competition, drawing users into a gaming dynamic that is familiar and exciting. Users are often prompted to compare their financial achievements with friends or the community, similar to how players in a casino might compare scores. These social features can significantly enhance engagement levels, as users are driven to outperform one another.

Community and Social Interaction

Incorporating casino-like elements creates opportunities for community interaction. Many finance apps now feature social networks where users can share progress, tips, and celebrate achievements. This sense of community mirrors a casino environment where players converse, strategize, and support each other’s journeys. By creating this sense of belonging, finance apps can deepen user loyalty and increase stickiness.

Turning Learning into Fun

Financial literacy is crucial in today’s economy, and many users feel overwhelmed by the complexity of managing finances. Finance apps can utilize casino elements to transform learning into a fun experience. For example, educational modules can feature interactive challenges, quizzes, and simulations that resemble games. This method not only makes learning enjoyable but also helps users retain essential information about financial management.

Feedback Mechanisms

Another important aspect of gamification is the provision for immediate feedback. In a casino, players receive instant results, whether they win or lose. Similarly, finance apps can provide real-time feedback on spending behaviors or investment strategies, allowing users to adjust their actions promptly. Instant feedback can lead to better financial outcome management as users feel more in control of their financial destinies.

Potential Pitfalls

Despite the numerous benefits of integrating casino elements into finance apps, there are potential downsides that developers and users must consider. One concern is the risk of fostering unhealthy financial habits. Users can become overly focused on the rewards and gamified aspects, potentially leading to impulsive financial decisions similar to gambling behaviors seen in casinos.

Ethical Considerations

Furthermore, developers should be mindful of the ethical implications of using gamification. While the intention is to encourage responsible financial behavior, there is a fine line between engagement and exploitation. It is essential for finance apps to promote a healthy financial ethos rather than simply driving profit motives through addictive behaviors.

The Future of Finance Apps

As technology continues to evolve, the integration of casino-like elements in finance apps is likely to blossom. More advanced algorithms and AI will further refine these features, resulting in personalized user experiences that cater to each individual’s interests and financial circumstances. As apps become more interactive and engaging, we can expect users to take greater control of their financial well-being.

Conclusion

The use of casino elements in finance apps is a reflection of the ongoing evolution in how users interact with their finances. By leveraging the principles of gamification, these apps can transform daunting financial tasks into engaging activities that promote better financial habits. While it’s essential to navigate the potential risks and ethical considerations, when implemented thoughtfully, this trend can lead to improved user experience and financial literacy. As we move into the future, the integration of gaming paradigms into financial platforms is likely to change how we perceive and manage our money.